Introduction to NVDA and the Stock Split

Nvidia (NVDA) has become a powerhouse in the tech world, known for its groundbreaking graphics processing units and contributions to artificial intelligence. As the company continues to thrive, investors are keenly interested in understanding key developments that could impact their portfolios. One such development is NVDA’s recent stock split—a move that has generated buzz across financial circles.

But what does this mean for current shareholders and potential investors? A stock split can seem like a simple maneuver on paper, yet it holds significant implications for market dynamics and investor sentiment. Whether you’re an experienced trader or just dipping your toes into the investment waters, grasping the intricacies of NVDA’s stock split is essential for making informed decisions moving forward. Let’s dive into what you need to know about this exciting event!

nvda stock split

The NVDA stock split has been a hot topic among investors lately. Nvidia, known for its cutting-edge graphics and AI technology, decided to execute this move as part of its growth strategy.

A stock split involves dividing existing shares into multiple ones to lower the trading price per share without affecting the company’s overall market capitalization. This makes buying shares more accessible to retail investors.

Nvidia’s 4-for-1 stock split in 2021 aimed to enhance liquidity and attract a broader base of shareholders. The decision reflects confidence in their future performance amidst booming demand for semiconductors.

Investors often view splits favorably, seeing them as a sign of corporate health or optimism about upcoming growth. However, it’s essential not to overlook potential risks associated with any investment following such events.

Benefits of a stock split for investors

A stock split can provide several advantages for investors. One key benefit is increased accessibility. When a company like Nvidia reduces its share price through a split, it allows more retail investors to buy in. This broader participation can enhance liquidity and trading volume.

Another advantage is the psychological effect on the market. A lower price per share may attract attention and create optimism among potential buyers, often boosting demand for the stock.

Additionally, stock splits signal confidence from management about future growth prospects. Companies typically pursue this strategy when they believe their shares have become too expensive relative to peers or historical performance.

Furthermore, splitting shares doesn’t change the overall value of an investor’s holdings; instead, it simply redistributes them into smaller units. This aspect helps maintain shareholder equity while potentially paving the way for upward momentum in stock prices as interest builds around the brand’s perceived affordability.

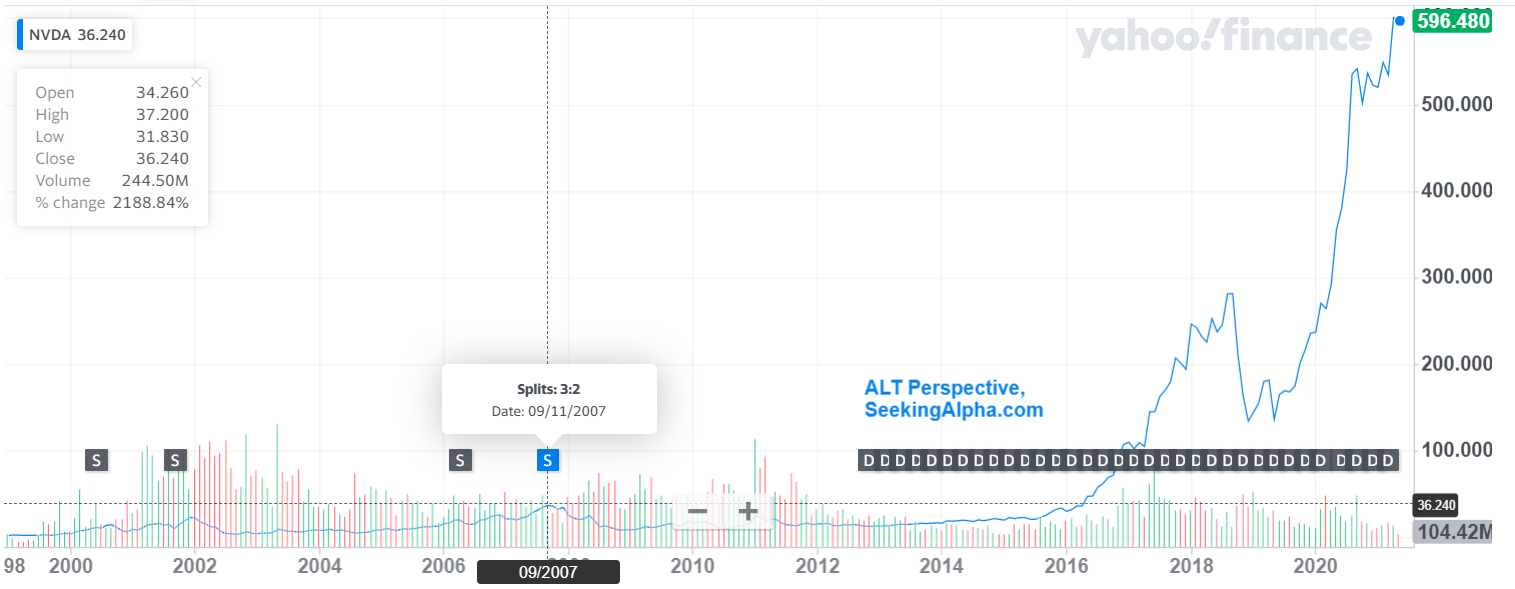

History of NVDA’s stock splits

Nvidia has a storied history when it comes to stock splits. The company first executed a split in 2000, reflecting its ambitious growth and rising share price. This move made shares more accessible to individual investors.

Fast forward to 2007, Nvidia announced another split as its valuation soared once again. Each time, these decisions have been driven by the desire to maintain liquidity and attract more retail investors.

The most notable split occurred recently in July 2021 when Nvidia opted for a 4-for-1 division of shares. This strategic choice aimed at making ownership easier amidst soaring demand for their technology products.

Each stock split not only reflects confidence in future growth but also serves as a tactic to keep shares affordable for potential new investors eager to join the growing tech giant’s journey.

Analysis of NVDA’s recent 4-for-1 stock split

Nvidia’s recent 4-for-1 stock split has sparked considerable interest among investors. A stock split effectively divides each share into four, making shares more affordable for a broader base of investors.

This significant move follows Nvidia’s remarkable growth trajectory. The company has dominated the graphics processing unit market, especially with the rise in demand for gaming and AI technologies.

The timing appears strategic as it coincides with strong quarterly earnings reports. By lowering the price per share, Nvidia aims to attract retail investors who might have been previously priced out.

Market reactions have generally been positive, suggesting that confidence in Nvidia’s long-term prospects remains robust. Many analysts see this as an indication of further expansion and innovation on the horizon.

Investors should monitor how this change affects trading volumes and shareholder sentiment moving forward.

The impact of the stock split on shareholders

The recent NVDA stock split has generated significant buzz among shareholders. By splitting its shares, Nvidia aimed to make its stock more accessible to a broader range of investors.

For existing shareholders, the immediate effect is an increase in the number of shares owned without altering their total investment’s value. This can enhance liquidity and potentially attract new buyers who may have previously considered the stock too expensive.

However, it’s crucial for investors to remember that a stock split does not change the company’s fundamentals or market capitalization. The perceived affordability might lead to increased trading activity, but whether this translates into long-term gains remains uncertain.

Shareholders should also keep an eye on how analysts and market trends react post-split. These factors could influence future share performance as newfound interest plays out in real time.

Factors to consider before investing in NVDA after the stock split

Investing in NVDA following the stock split requires careful consideration. First, evaluate the broader market conditions. Is there volatility or stability? This can affect your investment strategy.

Next, assess Nvidia’s fundamentals. Look into their earnings reports and growth potential. Are they innovating? How is their competition performing?

Also, consider your own risk tolerance. A lower share price might seem appealing but remember that past performance doesn’t guarantee future results.

Think about your investment horizon. Are you looking for short-term gains or long-term hold? Your approach will influence how you view the stock post-split.

Stay informed on industry trends as well; technology moves quickly and affects company valuations significantly.

Conclusion

The recent NVDA stock split has opened new doors for both current and potential investors. Understanding the implications of this decision is key in navigating your investment strategy.

Investors must weigh the benefits and risks associated with such a move. The market reaction often reflects broader trends, making it essential to stay informed.

Additionally, consider your financial goals. Are you looking for long-term growth or short-term gains? Your approach may shift based on how you interpret the effects of the stock split.

Thorough research can enhance your confidence when investing in NVDA post-split. Keep an eye on industry developments as they can influence share performance.

Staying proactive will help you make educated decisions that align with your investment objectives.

Introduction to the NVDA Stock Split

NVIDIA, a powerhouse in the tech industry, has made waves with its products and innovations. Recently, investors have turned their attention to the NVDA stock split.

A stock split occurs when a company divides its existing shares into multiple new ones. This action increases the number of shares while reducing each share’s price proportionally. For example, in a 4-for-1 split, if you held one share worth $400 before the split, you would own four shares priced at $100 each afterward.

NVIDIA initiated this move as part of its strategy to make shares more accessible to a broader range of investors. By lowering individual share prices, they aim to enhance liquidity and attract interest from retail investors who may have found previous pricing prohibitive.

Understanding how these splits function is crucial for any investor looking to navigate Nvidia’s evolving market landscape effectively.

What is a stock split and how does it work?

A stock split occurs when a company divides its existing shares into multiple new ones. This increases the total number of shares available while maintaining the overall market capitalization. For example, in a 4-for-1 split, shareholders receive four shares for every one they own.

Despite having more shares, each share’s price is adjusted accordingly. This means that the value remains constant immediately after the split. Investors often perceive this as beneficial because it can make individual shares more affordable.

Companies typically initiate stock splits to enhance liquidity and attract more investors. When stocks are priced lower per share, it may encourage increased trading activity. However, it’s essential to remember that a stock split does not change the company’s fundamental worth or financial health; it’s merely an accounting adjustment designed to improve accessibility for potential buyers.

Why did Nvidia decide to do a stock split?

Nvidia decided to execute a stock split primarily to improve the accessibility of its shares. As the company’s growth soared, so did its stock price, making it less affordable for smaller investors. By splitting the stock, Nvidia aimed to attract a wider base of shareholders.

A lower share price post-split can lead to increased trading volume and liquidity. This move often catches the eye of retail investors who may have found buying whole shares too costly before.

Moreover, a stock split can generate buzz in financial markets. It sends a signal that Nvidia is confident about its future prospects and wants more people involved in its success story.

This strategic decision aligns with Nvidia’s focus on fostering long-term shareholder value while maintaining momentum during rapid expansion phases.

Potential benefits and risks for investors

Investors often view stock splits as a positive signal. A lower share price can attract more retail investors, increasing overall liquidity. This demand may drive the stock’s value higher post-split.

However, potential risks lurk beneath the surface. A split doesn’t change the company’s market capitalization or fundamentals. If underlying business performance falters, even a lower share price won’t shield it from decline.

Additionally, some investors might mistakenly believe a split automatically means growth is imminent. Market trends and economic indicators still play crucial roles in determining stock performance.

Understanding these dynamics is key for smart investing decisions following an NVDA stock split. Balancing optimism with caution ensures that you’re prepared for both upside potential and downside risks associated with this corporate action.

How to take advantage of the stock split

Taking advantage of the NVDA stock split involves a few strategic steps. First, consider your investment goals and risk tolerance. A lower share price may attract new investors, which can create upward momentum.

Monitor market reactions following the split. Increased interest often leads to heightened trading activity, potentially driving prices higher in the short term.

It’s also wise to evaluate Nvidia’s fundamentals before jumping in. Strong earnings reports or product innovations can further boost investor confidence post-split.

Think about dollar-cost averaging if you’re planning on buying more shares. This approach helps spread out your investments over time rather than committing all at once during volatility.

Staying informed is key; keep an eye on analyst ratings and market trends related to NVDA after the stock split for optimal timing when entering or expanding your position.

nvda stock split

Nvidia Corporation, a leader in graphics processing technology, recently announced an NVDA stock split. This decision sparked significant interest among investors and market watchers alike.

A stock split occurs when a company divides its existing shares into multiple new shares. For Nvidia, this means that shareholders will own more shares at a lower price per share. This can make the stock more accessible to retail investors who may have found the previous price prohibitive.

The NVDA stock split is designed to enhance liquidity and attract new investors to the table. Lower share prices can encourage trading activity and create a broader base of support for the company’s stock.

Investors should keep an eye on potential market reactions following such corporate maneuvers. The impact on shareholder value can vary based on overall market conditions and investor sentiment toward Nvidia’s growth prospects.

Conclusion

The NVDA stock split has garnered significant attention from investors and analysts alike. As Nvidia continues to thrive in the semiconductor market, understanding the implications of its recent 4-for-1 stock split is crucial for current and potential shareholders.

Stock splits can serve as a strategic move to make shares more accessible, increasing liquidity in the market. This makes it easier for new investors to enter without breaking the bank on high-priced stocks. For established shareholders, it often signals confidence in company performance and future growth.

Nvidia’s decision to pursue this particular split aligns with its robust financial standing and ongoing expansion into sectors like gaming, AI, and data centers. However, while there are evident benefits such as increased share affordability and potentially heightened interest from retail investors, risks still linger.

For those considering investing post-split, weighing factors such as overall market conditions and Nvidia’s projected growth trajectory becomes essential. With innovation driving much of its business strategy forward—especially regarding advancements in AI technology—the company’s outlook remains promising yet should be approached with careful analysis.

The landscape surrounding NVDA will likely evolve following this latest move. Keeping an eye on how the stock performs over time will provide valuable insights into whether this strategy pays off for both old-timers and newcomers alike.